A downloadable guide on retirement is a great asset for a financial planner or adviser to include on their website. Prospects are often looking to educate themselves before making an enquiry, and a PDF resource can be a powerful way to assist them in that effort whilst promoting your brand to them.

What makes a good retirement guide, however? How long should it be, for instance, and how should it be presented? What kind of information should it contain, and how much of a “sales pitch” should it be?

These are important questions and many of the answers involve striking a delicate balance. Here at Clients Plus, we specialise in content for financial firms and so wanted to offer our thoughts on what to look for in a great retirement guide.

We hope you find value in this content and invite you to check out our content marketplace for examples of our own retirement guides, articles and other resources.

Title and Cover Pages

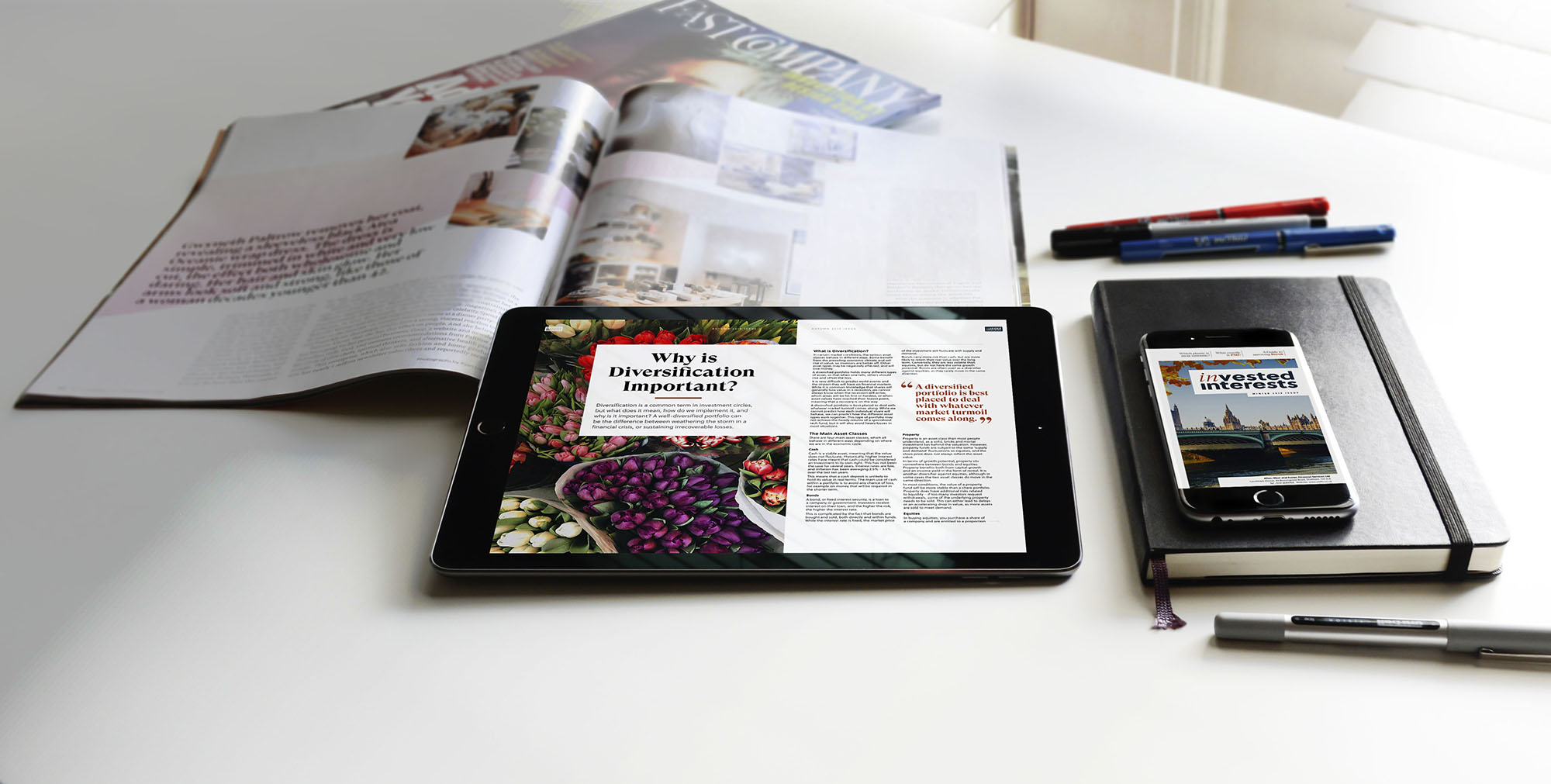

We’ve all heard the adage that you shouldn’t judge a book by its cover. The reality, however, is that human beings naturally do this when browsing books in a shop. If the book title looks intriguing and the cover appeals to us, then we’re more likely to pick it up from the shelf and flick through the pages to find out more.

The same dynamic is at work when visitors to your website see an invitation to download your PDF guide on retirement. If it looks boring, unappealing or low-quality in its design, then they are less likely to click on it and save it to their phone or desktop device.

Whilst presentation isn’t everything, of course, you will want to encourage as much engagement with you content as possible. So, make sure you factor the design and title of your retirement guide into your choice.

Length and Layout

Another aspect of your retirement guide to consider is how long it is. On the one hand, a 4-page PDF guide is likely to be too short to contain the depth of content that your readers are looking for. Yet on the other hand, a 50-page report is unlikely to appeal to most people unless they have a background in financial services themselves.

In our experience here at Clients Plus, a retirement guide could be 8-12 pages long and cover the main points of the subject at hand. Once you start getting into PDFs that are dozens of pages long you are starting to move away from a “guide” and more towards a “white paper”, which typically serves a different purpose.

The former, in short, is more useful for the majority of financial planners and advisers which are looking to generate interest and engagement from a retail audience. For firms seeking to promote brand reach amongst professional investors and institutions, however, a whitepaper can often work well as it offers some academic research which they can leverage for their own content marketing.

Depth – with Tempered Jargon

Put yourself in the shoes of your target audience. As a financial planner or adviser, you will be familiar with the technical pension language of your sector, yet for most people looking for pension advice they will be intimidated and alienated by a retirement guide which leans too heavily on this kind of content.

It’s a difficult balance to strike. For instance, you do not want your retirement guide to be too tempered down or have too informal language. Yet you do not want people’s eyes to glaze over within one paragraph of reading your guide.

As such, here at Clients Plus, our retirement guides seek to strike a balance which you might call “tempered jargon” or “informed informality”. This tries to find a middle-ground between the two extremes, using copy which broadly mirrors the kind of language that a financial adviser might use in the first meeting with a client who is still learning about pensions.

For instance, a section of your retirement guide might talk about pension transfers from a final salary scheme to a personal pension (e.g. a self-invested personal pension). It is difficult to talk about this important subject without using some jargon, so a good retirement guide would take the time to briefly explain these terms as the content progresses.

Examples & Stories

People love stories and there is no reason why they should be excluded from a guide on retirement. Indeed, sometimes this is the best way to open the content on a subject such as pensions. It helps to ground the subject in real life and show how it might be relevant to the reader’s own situation with their retirement.

Stories also help to illustrate points which can be difficult to describe in a purely technical way, and they also help to break up a guide so that it isn’t simply a wall of educational text – providing some nice cognitive “breathing space”.

Leaving a Desire for More

Sometimes financial planners and advisers want a retirement to cover every possible point on the subject at hand, providing all of the information that the reader could ever possibly need. Whilst this is a commendable desire, it isn’t usually the best approach.

First of all, it’s not usually a realistic goal. It would take a guide of immense page length to achieve this ambition – which, as we mentioned above, is unlikely to retain the reader’s attention. Secondly, it also does not serve the main purpose of a downloadable guide on retirement.

Think about it. What do you want your retirement guide to ultimately achieve? Do you want your prospect to download your PDF guide from your website, read it all and then decide that they do not need to get in touch with you (since they feel like they’ve “learned all that they need to know”)? Or, do you want to give them just enough content to feel like they’ve received great value for you, but also feel like they really need to get in touch with you to get the full value they’re looking for?

The chances are that you’re after the latter. As such, a good retirement guide will find a good balance in the amount of content and value it offers to the reader. It will leave them hungry to find out more and to take the next step on your buyer’s journey.